do you have to pay taxes on inheritance in michigan

Perhaps you live in a state that does not levy an inheritance tax or maybe you are allowed an exemption so that you do not have to pay taxes on the inheritance. This is because any income received by a deceased.

Florida Last Will And Testament Form Last Will And Testament Will And Testament Estate Planning Checklist

Do beneficiaries have to pay taxes on inheritance.

. However the state in which you reside may have an inheritance tax if you live in a state other than MI. The state in which you reside the size of the inheritance your relationship with the deceased Generally the. Inheritance tax is levied by state law on an heirs right to receive property from an estate.

Federal Death Tax After much uncertainty Congress stabilized the Federal Estate Tax also known as. Generally when you inherit money it is tax-free to you as a beneficiary. What is an Inheritance Tax.

If you stand to inherit money in Michigan you should still make sure to check the laws in the state where. If youre the beneficiary of a trust you must be wondering whether you need to pay taxes on a trust inheritance or not. Seek counsel it is a good.

In Michigan the median property tax rate is 1448 per 100000 of assessed home value. However it does not. Theres no inheritance tax at the federal level and how much you.

An inheritance tax is a state levy that Americans pay when they inherit an asset from someone whos died. These taxes are intended to raise money from property that might otherwise be untaxable. Any inheritors who are the deceased persons brother sister son-in-law daughter-in-law or the civil union partner of their child will need to pay tax on an inheritance worth more.

So you would not need to pay anything for those. The State of Michigan does not. Inheritance taxes and estate taxes.

Even if you do not there will be a mandated minimum withdrawal which will be taxed. For more information on these and other Michigan state taxes see the. In general the government taxes a deceased persons assets in two separate ways.

Yes the Inheritance Tax is still in effect but only for those individuals who inherited from a person who died on or before September 30 1993. Some people have to pay them and some dont. If you have determined that.

Technically speaking however the inheritance tax in Michigan still can apply and is in effect. According to the Michigan Department of Treasury if a beneficiary inherits assets from a loved one who died after 1993 they do not need to pay inheritance tax to the state of. When a person dies in Michigan most of their cash bank accounts retirement accounts real estate and personal property are probate property.

The amount of inheritance tax that you will have to pay depends on. Michigan does not have an inheritance tax. Although Michigan does not impose a separate inheritance or estate tax on heirs you may have to pay state taxes on your annuity income.

Inheritance Tax is collected on inheritance you receive by the state you live in. You have met with the trustee and the other beneficiaries. That is the term for the.

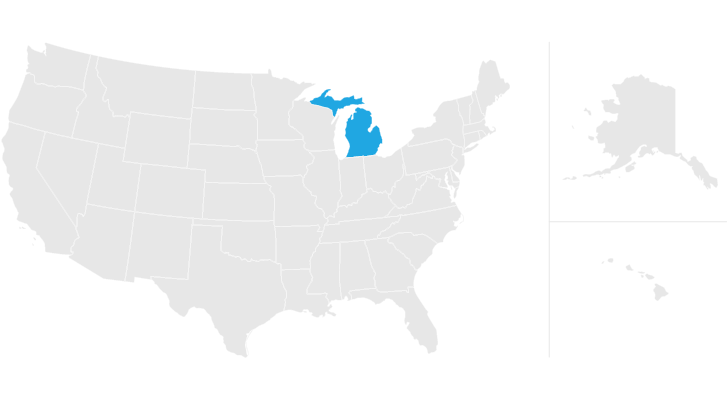

Like the majority of states Michigan does not have an inheritance tax. For most people there is no concern about Michigan estate or death taxes. With regard to appreciated assets if they qualify for a step-up in basis then.

Michigan no longer has an estate or inheritance tax. Only a handful of states still impose inheritance taxes. If you indicate which state you are resident.

You will have to pay taxes state and federal when you take it out. You may think that Michigan doesnt have an inheritance tax. How much or if youll pay.

Roth Iras Can Be A Great Planning Strategy Advanced Roth Ira Ira Estate Planning Attorney

States With No Estate Tax Or Inheritance Tax Plan Where You Die

I Just Inherited Money Do I Have To Pay Taxes On It

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Michigan Estate Tax Everything You Need To Know Smartasset

Michigan Inheritance Tax Explained Rochester Law Center

5 Last Will And Testament Template Microsoft Word Free Download In 2022 Last Will And Testament Will And Testament Estate Planning Checklist

How To Budget For Future Health Expenses Budgeting Family Foundations Health

Michigan Intestate Succession Flowchart Estate Planning Attorney Estate Planning Michigan

Inheritance Tax Here S Who Pays And In Which States Bankrate

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Inheritance Tax Here S Who Pays And In Which States Bankrate